Redefining Economic Partnership in a Shifting Global Order

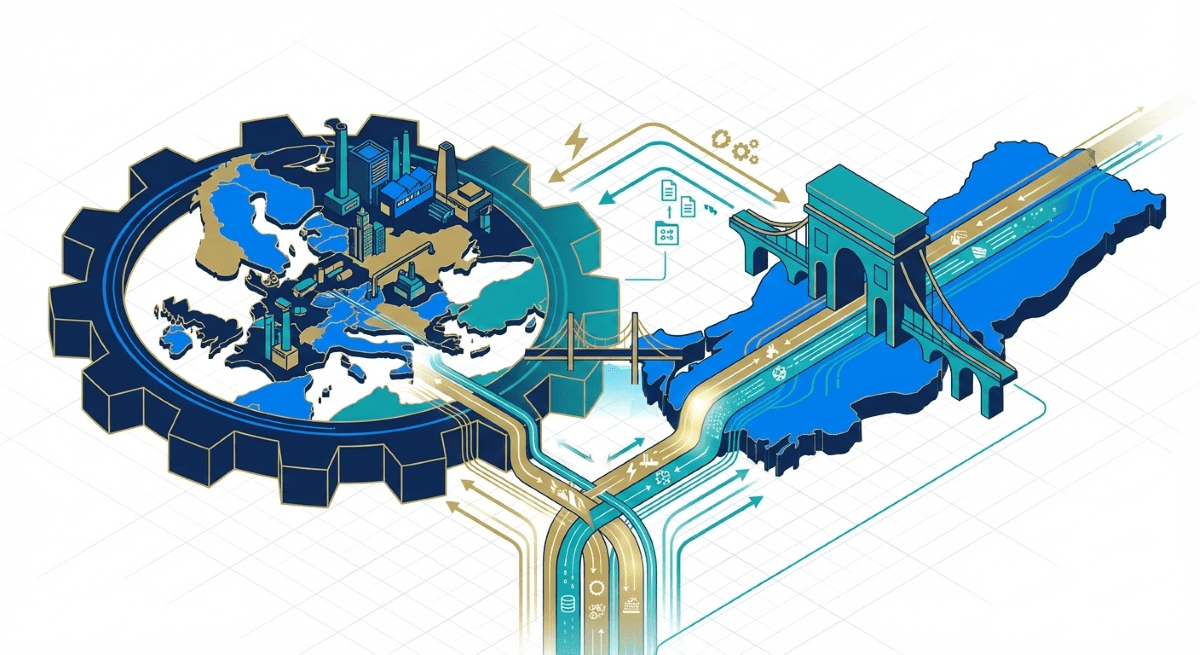

The economic relationship between Turkey and Europe is being redefined. What was once a simple framework— Europe as the consumption powerhouse and advanced manufacturing center, Turkey as low-cost producer—is evolving into something more complex and interdependent, shaped by supply chain restructuring, energy security, demographic divergence, and geopolitical shifts.

Europe faces aging populations and energy vulnerabilities. Turkey navigates economic volatility and its position between East and West. Yet these challenges create opportunities for deeper integration and strategic repositioning in a multipolar world.

The Demographic Divide: Europe’s Challenge, Turkey’s Advantage

Europe is aging rapidly. The EU’s median age exceeds 44.5 years, with Germany, Italy, and Spain facing severe workforce contractions. By 2050, nearly 30% of Europe’s population will be over 65, creating labor shortages and dampening growth.

Turkey offers a contrast. With a median age of 34 and 86 million people, it maintains a young, growing workforce. This demographic window provides competitive advantages in manufacturing, services, and consumption-driven sectors for another decade.

This asymmetry creates natural complementarities. Europe needs workers and dynamic markets. Turkey offers both, with geographic proximity that makes integration more feasible than alternatives in Asia or Africa.

Supply Chain Reconfiguration: Turkey as Europe’s Near-Shore Partner

Supply chain disruptions have forced European companies to embrace “near-shoring”—bringing manufacturing closer to end markets. Turkey is positioned as Europe’s most viable near-shore alternative.

Geographic proximity delivers goods to major European markets in days, not weeks. Manufacturing capability is proven across automotive, textiles, white goods, and electronics. Cost competitiveness remains significant compared to European production. The customs union facilitates goods trade, though modernization could unlock further integration.

The question for European manufacturers is whether Turkey becomes their primary near-shore hub—or whether North Africa or Eastern Europe captures that role.

Energy Security: A Shared Vulnerability and Opportunity

Energy has become a strategic priority. Europe’s Russian gas dependency, exposed in 2022, revealed dangerous vulnerabilities. Turkey faces import dependencies but holds unique strategic assets.

Turkey’s geography makes it a natural transit route for Caspian, Middle Eastern, and East Mediterranean energy flows to Europe. Both regions are investing heavily in renewables—Turkey’s solar capacity is expanding, while Europe leads in offshore wind. Turkey is positioning itself in green hydrogen production, and its LNG infrastructure has become strategically important for European energy security.

Energy interdependence is deepening, creating opportunities for infrastructure investment and technology partnerships.

The Digital Economy: Innovation Ecosystems and Tech Talent

Turkey’s digital economy is maturing rapidly. Istanbul has emerged as a regional tech hub with a thriving startup ecosystem. E-commerce is growing faster than most European markets. Turkey produces thousands of engineering graduates annually, making it an attractive nearshore destination for European software development and R&D centers. The fintech sector is innovating rapidly, with European financial services companies increasingly partnering with Turkish players.

The digital domain offers clear pathways for deeper integration—less constrained by traditional trade barriers, more driven by talent mobility and capital flows.

Manufacturing Transformation: From Textiles to Advanced Industries

Turkey’s manufacturing is climbing the value chain from traditional low-cost production toward technology-intensive industries. It produces over 1.4 million vehicles annually as a major automotive exporter deeply integrated into European supply chains. Turkey is Europe’s factory for appliances, producing white goods for brands across the continent. The defense industry has developed significant capabilities in drones and sophisticated systems. Turkish manufacturers increasingly produce complex machinery and precision components—moving beyond assembly to engineering and design.

This industrial upgrading makes Turkey more valuable as an economic partner while introducing competitive dynamics with European manufacturers.

Trade Flows: Deepening Integration Despite Political Tensions

Despite political friction, economic ties continue deepening. Europe remains Turkey’s largest trade partner, receiving 41% of Turkish exports. European companies are among the largest foreign investors in Turkey. Services trade is growing across tourism, logistics, and business services. Millions of people of Turkish origin in Europe create business networks and cultural connections that facilitate economic ties.

The relationship has proven resilient to political turbulence—driven by practical commercial interests that transcend diplomatic challenges.

Geopolitical Positioning: Turkey’s Strategic Ambiguity

Turkey’s geopolitical stance adds complexity. It is a NATO member but pursues independent foreign policies, maintains relations with Russia while Europe seeks distance, and positions itself as a bridge to the Middle East and Central Asia.

This strategic ambiguity creates opportunities and risks. Turkey can serve as a gateway to markets beyond Europe’s reach, but businesses must navigate periodic tensions and policy shifts. The calculation increasingly is that Turkey’s strategic importance—in energy transit, migration management, and supply chain security—outweighs the complications.

Challenges That Could Disrupt the Partnership

Several factors could slow deeper integration: economic volatility with high inflation and currency instability in Turkey, rule of law concerns affecting investment decisions, stalled EU accession negotiations creating uncertainty, politically sensitive migration pressures, and competing alternatives from North Africa and Eastern Europe.

The 2040 Vision: Strategic Partners or Drifting Apart?

Two scenarios are possible by 2040. Deep integration where Turkey becomes Europe’s primary near-shore hub, energy corridor partner, and co-innovator in green technologies. Or gradual divergence where ties continue but don’t deepen, with Turkey orienting toward Middle Eastern and Asian markets while Europe sources from North Africa and reshored operations.

Which path prevails depends on policy choices in Ankara and European capitals—and whether pragmatic economic interests overcome political obstacles.

Navigating the Relationship: Practical Imperatives

For businesses and investors: diversify but don’t abandon Turkey—it should be part of a supply chain strategy, not a single-source solution. Invest in on-the-ground knowledge through local partnerships and cultural competence. Balance long-term positioning with operational flexibility to navigate volatility. Engage in policy dialogue to help shape more favorable economic frameworks.

A Partnership at a Crossroads

Turkey and Europe can deepen their economic partnership, leveraging complementary strengths in demographics, manufacturing, energy, and innovation—or drift toward a more transactional relationship.

The global environment—supply chain fragmentation, energy security imperatives, competitive pressure from Asia—suggests the logic for deeper integration is stronger than ever. But realizing that potential requires navigating political complexity, managing economic volatility, and making long-term commitments.

For those willing to engage with that complexity, the Turkey-Europe economic corridor offers one of the most compelling opportunities in global trade today.