The Fragmentation of Globalization

For decades, globalization moved in one direction: toward deeper integration, borderless markets, and multilateral institutions governing trade. The World Trade Organization symbolized this vision—a universal framework where rules applied equally, and commerce flowed with minimal friction across continents.

That era is ending.

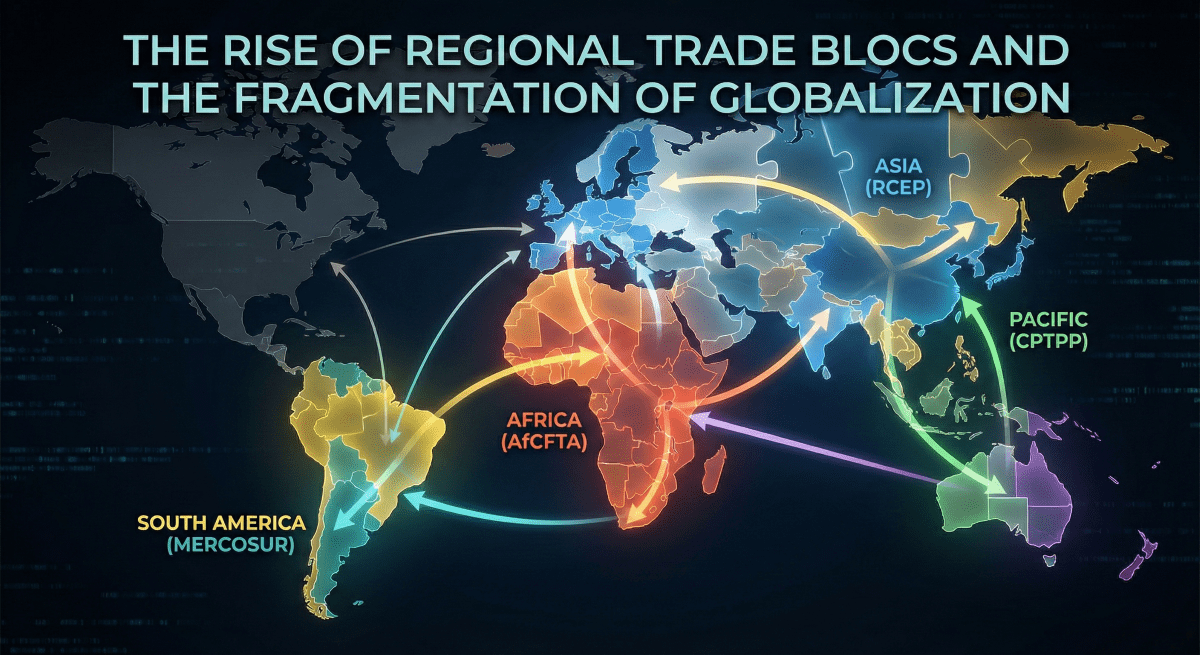

What’s emerging instead is a world of regional trade blocs—economic alliances defined not by global consensus, but by geography, shared interests, and strategic necessity. From the Regional Comprehensive Economic Partnership in Asia to the African Continental Free Trade Area, these blocs are rewriting the architecture of global commerce. They represent not the collapse of trade, but its reorganization into distinct spheres of influence that operate with different rules, priorities, and power centers.

This shift carries profound implications. It signals a move away from dependence on traditional Western markets and institutions, and toward a multipolar system where emerging economies set their own terms. For businesses, investors, and policymakers, understanding this transformation is no longer optional—it’s essential.

The New Geography of Trade

The most striking feature of this new landscape is its scale and diversity. Regional trade agreements are not new, but what’s different now is their ambition, membership, and economic weight.

The Regional Comprehensive Economic Partnership, signed in 2020, brings together 15 Asia-Pacific nations including China, Japan, South Korea, Australia, and the ASEAN bloc. It covers nearly a third of the world’s GDP and population, creating the largest free trade area in history. Unlike previous Asian agreements, RCEP doesn’t require Western participation or approval. It’s a framework built by Asian economies, for Asian economies.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership offers a different model—11 Pacific Rim countries committed to high regulatory standards, labor protections, and environmental provisions. What began as a U.S.-led initiative has evolved into an independent platform, with the United Kingdom signing the accession protocol in 2023 and other nations expressing interest.

In Africa, the Continental Free Trade Area represents perhaps the most ambitious experiment in regional integration. Covering 1.3 billion people across 54 countries, it aims to create a single market for goods and services, facilitate investment, and establish a customs union. If successful, it could transform Africa from a collection of fragmented markets into a unified economic force.

South America’s Mercosur, Europe’s single market, and smaller agreements across the Middle East and Central Asia complete the picture. Each operates with distinct rules, priorities, and governance structures. Collectively, they’re creating a world where trade flows increasingly within regions rather than globally.

Why Fragmentation Is Accelerating

Several forces are driving this regionalization, and none show signs of reversing.

Geopolitical rivalry tops the list. The strategic competition between the United States and China has made multilateral cooperation more difficult and encouraged countries to secure supply chains within trusted networks. Economic policy is increasingly viewed through a security lens, with nations prioritizing reliability over efficiency.

Supply chain resilience has become a imperative following pandemic disruptions and geopolitical shocks. Companies and governments alike recognize the risks of excessive concentration. Regional trade blocs offer a way to maintain access to diverse suppliers and markets while reducing exposure to distant disruptions.

The erosion of multilateral institutions plays a role as well. The WTO’s dispute resolution system remains paralyzed, and consensus on new trade rules has proven elusive. Frustrated by gridlock, countries are pursuing regional agreements where smaller groups can reach consensus more easily.

Economic pragmatism matters too. For emerging economies, regional integration offers market access without the political complications of dealing with Western powers. It allows countries to set standards that reflect their development priorities rather than accepting frameworks designed elsewhere.

Reducing Dependence on Western Markets

Perhaps the most significant aspect of this shift is how it’s redistributing economic power. For much of the modern era, global commerce meant commerce with or through the West—specifically the United States and Europe. These markets set standards, controlled financial infrastructure, and dominated global supply chains.

That’s changing. Asian economies are increasingly trading with each other rather than routing commerce through Western intermediaries. African nations are building intra-continental supply chains that bypass traditional colonial trade patterns. Latin American countries are exploring alternatives to dollar-based transactions.

This doesn’t mean the West is becoming irrelevant. The United States and European Union remain enormous markets with substantial purchasing power. But they’re no longer the only path to prosperity, and their ability to set unilateral terms is diminishing.

Consider manufacturing. China has evolved from the world’s factory into a sophisticated producer serving increasingly diverse markets. Indian manufacturers are supplying regional partners across Asia and Africa. Vietnamese exporters are diversifying beyond traditional Western buyers. These shifts reflect a fundamental rebalancing—emerging markets are less dependent on Western consumption and more integrated with each other.

The financial dimension is equally important. Regional payment systems, bilateral currency arrangements, and discussions of alternative reserve currencies all point toward reduced dollar dominance. While the dollar’s position remains strong, its monopoly is weakening as countries build financial infrastructure that doesn’t require routing through New York or London.

The Business Implications

For companies navigating this environment, the old playbook no longer applies. Global strategies built around centralized production and universal standards face mounting challenges.

Regional customization is becoming essential. Products, compliance frameworks, and distribution strategies must align with regional requirements that vary significantly across blocs. What works in RCEP markets may not transfer to the African Continental Free Trade Area.

Supply chain architecture requires rethinking. Rather than single global supply chains optimized for cost, companies are building regional networks optimized for resilience and access. This means multiple production hubs, diversified sourcing, and strategic inventory placement.

Partnership strategies are shifting as well. Success increasingly depends on understanding regional dynamics and building relationships with local players who navigate these markets effectively. The era of parachuting in with a universal product is ending.

What Comes Next

The trajectory is clear even if the destination isn’t. Trade will continue flowing across borders, but the framework governing that flow is fracturing into regional systems with different rules, standards, and power structures.

Some view this fragmentation with alarm, seeing it as a retreat from the prosperity that globalization delivered. Others see opportunity—a more balanced system where emerging economies have greater agency and multiple development models can coexist.

The reality is likely both. Fragmentation creates inefficiencies and raises costs, but it also distributes risk and enables innovation. It complicates global coordination while empowering regional solutions. It reduces Western dominance while creating new dependencies.

For businesses and policymakers, the imperative is adaptation. Understanding regional dynamics, building flexible strategies, and maintaining access to multiple trade blocs will define competitiveness in the coming decades. The winners won’t be those who resist this transformation, but those who master the complexity it creates.

Globalization isn’t ending. It’s evolving into something more complex, more regional, and ultimately more reflective of a world where economic power is no longer concentrated in a few Western capitals. That transformation will define the next chapter of global commerce.